Majority Ownership of Underexplored, Belt-Scale Gold Project in Western Australia

Sarama Resources Ltd. (‘Sarama’ or the ‘Company’) (ASX:SRR)(TSXV:SWA) is pleased to advise that it has completed the acquisition of a majority interest(1) in the Cosmo Gold Project (the ‘Project’) in Western Australia. This follows satisfaction of all outstanding conditions precedent and receipt of final securities exchange approval

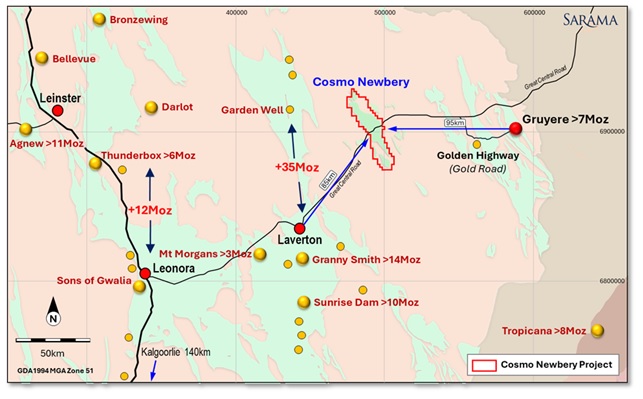

The 580km² Cosmo Gold Project(2)covers the entirety of the Cosmo-Newbery Greenstone Belt and is located approximately 85km north-east of Laverton in a region known for its prolific gold endowment (refer Figure 1). As one of the last effectively unexplored greenstone belts in Western Australia, the Project presents a unique and compelling opportunity for the Company.

Highlights

Sarama’s President, CEO & MD, Andrew Dinning commented:‘We are very pleased to have completed the acquisition and gained control of the Cosmo Gold Project which we view as a compelling greenfields exploration opportunity in Western Australia’s Eastern Goldfields. The Project has excellent access and importantly scale, favorable lithological and structural settings and historical high-grade workings dating back to the 1890’s. Sarama has already commenced a broad-scale, systematic exploration program and looks forward to working up the Project’s first drill targets. We would also like to acknowledge the work done on the Project by Cosmo Gold Ltd and look forward to the ongoing support of the Traditional Owners for Sarama’s planned endeavors.’

Cosmo Newbery ProjectThe Project is comprised of 7 contiguous exploration tenements covering approximately 580km² in the Eastern Goldfields of Western Australia, approximately 85km north-east of Laverton and 95km west of the world-class Gruyere Gold Mine. The Project is readily accessible via the Great Central Road which services the Cosmo Newbery Community.

The Project captures one of the last unexplored greenstone belts in Western Australia and with a strike length of +50km, the Cosmo Newbery Belt represents a large and prospective system with gold first being discovered in the area in the 1890’s. Multiple historical gold workings are documented within the Project area and work undertaken to date has identified multiple exploration targets for follow up.

Despite this significant prospectivity, the Project has seen virtually no modern explorationor drilling of merit due to a lack of land access persisting over a significant period. As a result, the Project has not benefited from the evolution of geochemical and geophysical techniques which now facilitate effective exploration in deeply weathered and complex regolith settings which is particularly pertinent given approximately 75% of the Project area is under cover.

Following the relatively recent securing of land access, the Project is now available for systematic and modern-day exploration programs to be conducted on a broad-scale. It is anticipated that future exploration programs will initially follow-up preliminary targets generated from regional soil sampling and limited reconnaissance drilling programs, a majority of which extended to approximately 5m below surface with a small percentage extending up to 30m below surface.

Transaction & Joint Venture SummaryPursuant to the binding Asset Sale and Purchase Agreement executed by Sarama and a 100%-owned subsidiary with Cosmo Gold Limited (‘Cosmo‘) and Adelong Gold Limited (‘Adelong‘), Sarama has acquired an initial 80% of Cosmo’s interest in the Project (the ‘Transaction‘).

An unincorporated joint venture has been formed between Sarama (via its subsidiary) and Cosmo on industry-standard terms to advance exploration on the Project, with the initial participating interests being 80% Sarama and 20% Cosmo. The joint venture structure will ensure continuity of exploration and Traditional Owner relationships and provide for transfer of technical knowledge for the benefit of the Project. Under the terms of the joint venture, Sarama has been appointed as operator and will assume sole responsibility for funding all activities on the Project up to the point of a ‘Decision to Mine’ being made. Within a 2-year period following completion of the Transaction, Sarama has, subject to the prior approval of TSX Venture Exchange (‘TSX-V‘), the right to acquire the remainder of Cosmo’s interest in the Project for consideration of A$1,250,000, payable in cash or shares at Sarama’s election. In the event the right is not exercised, the parties will continue under the established joint venture relationship. Upon a ‘Decision to Mine’ being made, the parties will be required to contribute to joint venture costs in proportion to their participating interests. In the event a party does not contribute its share of proportional joint venture costs, the participating interest of that party shall be diluted according to an industry standard formula and if a party’s interest is diluted to 10% or less, that party’s interest shall be automatically converted to a 0.5% net smelter return royalty and the non-diluting party shall have a 100% interest.

The following information is provided for exchange compliance purposes:

-

The Asset Sale & Purchase Agreement in relation to Sarama, via a 100%-owned subsidiary, acquiring an interest in the Project is dated 12 August 2024, was fully executed 13 August 2024 and disseminated on TSX-V newswire services on 13 August 2024 and on the Australian Securities Exchange (‘ASX‘) platform on 14 August 2024. The Transaction is being conducted at arm’s length and no Finders’ Fees are payable.

-

In consideration for Sarama, via a 100%-owned subsidiary, acquiring an initial 80% interest of Cosmo’s interest in the Project, Sarama has made the following payments:

-

Cash consideration payment of A$100,000 to Cosmo;

-

Issuance to Adelong, as directed by Cosmo, of 25,000,000 Chess Depository Instruments (‘CDIs’) in Sarama and 7,500,000 options (exercisable at A$0.05/option for a period of 2-years after issue and converting to Sarama CDIs at a rate of 1:1) to settle and fully release Cosmo from indebtedness to Adelong;

-

Cash payments for project-related expenses of: approximately A$76,000 to various governmental agencies in connection with mineral tenure fees; approximately A$139,000 to various mining services suppliers in connection with soil geochemistry works; and approximately A$112,000 to Native Title groups in connection with land access agreement fees.

-

-

Sarama advises it has issued news releases in relation to the acquisition of an interest in the Project on the following dates:

-

5 November 2024

-

14 October 2024

-

25 September 2024

-

13 August 2024

-

16 July 2024

-

17 June 2024

-

For further information, please contact:Andrew Dinning or Paul SchmiedeSarama Resources Ltde: info@saramaresources.comt: +61 8 9363 7600

FOOTNOTES

-

Sarama, via its 100%-owned subsidiary, has acquired from Cosmo an 80% interest in all the Project’s Exploration Licences, with the exception of E38/2274 for which Sarama has acquired an effective 60% interest (with Cosmo retaining a 15% interest and an existing joint tenement holder retaining a 25% interest). The tenements in which Sarama has acquired an 80% interest account for approximately 80% of the total area of the Project. For a period of 2-years following completion of the Transaction, Sarama has the right to acquire Cosmo’s remaining 20% interest, which would result in Sarama having an aggregate 100% interest, in all the Project’s Exploration Licences (with the exception of Exploration Licence E38/2274 which would be held 75% by Sarama and 25% by an existing joint tenement holder in the event that Sarama exercises the option to acquire Cosmo’s remaining interest in the Project).

-

The Project is comprised of the following contiguous Exploration Licences: E38/2851, E38/3456, E38/2627, E38/2274, E38/3525, E38/3249 and E38/2774 covering approximately 580km². Prior to completion of the Transaction, Cosmo had a 100% interest in all the Project’s Exploration Licences with the exception of E38/2274 for which Cosmo held a 75% interest.

CAUTION REGARDING FORWARD-LOOKING INFORMATIONInformation in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the prospectivity of the Cosmo Gold Project, information with respect to Sarama having or acquiring mineral interests in areas which are considered highly prospective for gold and other commodities and which remain underexplored, costs and timing of future exploration, the potential for exploration discoveries and generation of targets, the intention to gain the best commercial outcome for shareholders of the Company, timing and receipt of approvals, consents and permits under applicable legislation and the completion of a transaction to acquire Cosmo’s residual interest in the Cosmo Gold Project. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company’s publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company’s ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political and security-related events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSON’S STATEMENTScientific or technical information in this disclosure that relates to exploration is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information in the form and context in which it appears.

This announcement has been authorised by the Board of Sarama Resources.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE:Sarama Resources Ltd.

View the original press release on accesswire.com

![]()

News Provided by ACCESSWIRE via QuoteMedia